L’analisi di Mattia Ciprian, co-fondatore e presidente di modefinance: “più partnership, educazione finanziaria e sandbox per agevolare lo sviluppo del fintech in Italia”.

Oltre un quarto delle piccole e medie imprese a livello globale ha già fatto uso di servizi fintech in alternativa ai tradizionali canali bancari nel 2019. Ecco il perché di una rivoluzione.

Per far fronte ai possibili ritardi nei pagamenti dei crediti commerciali pendenti da parte dei clienti esteri, l’anticipo fatture online oggi costituisce un’alternativa al tradizionale canale bancario.

Invoice trading e lending crowdfunding sono soluzioni alternative ai tradizionali canali bancari per le esigenze di liquidità delle imprese nel breve e medio periodo. Vediamo perché.

Secondo gli ultimi dati del Politecnico, in Italia il settore dell’anticipo fatture online è cresciuto del 91% in un anno grazie a un servizio nettamente migliore rispetto a quello bancario e tradizionale.

Secondo l’ultimo report del Cambridge Center for Alternative Finance e Banca Mondiale esiste una correlazione positiva tra regolamentazione e sviluppo della finanza alternativa in un determinato Paese.

Quali sono le differenze dal punto di vista dei volumi e della diffusione della finanza alternativa in Italia rispetto al resto del mondo, per chi incomincia solo oggi ad affacciarsi a questo affascinante settore.

Gli appuntamenti dove incontrare e conoscere il team di CashMe nel corso delle prossime settimane.

Cresce il nostro team, aumentano gli investitori istituzionali, l’invoice trading guida la crescita della finanza alternativa in Italia: il bilancio di metà anno di CashMe, a firma di Marcello Scalmati.

After the global financial crisis of 2008 a mix of factors, among those the central bank’s expansive monetary policy, have created a challenging investment environment.

With low rates in the bond market and a stock market at its highest, investors need to find alternative investment solutions. Invoice trading is one of them, providing a new, high return, secured, short-term asset class. This was the subject analyzed by Fermat Capital Management in the study conducted by Adam Dener and published on November 2017. It refers to the U.S. market but we believe it perfectly applies also to the European one.

Monetary policy and regulation post the Global Financial Crisis (GFC) have created a challenging investment environment [..]. Low interest rates have resulted in an increase in fixed rate, long-term product issuance and a decrease in floating rate, short-term product issuance. This has left investors exposed to reduced asset prices and potential mark-to-market losses, as well as increased default risk as interest rates rise.

With limited short-term product available, investors have been forced to manage short-term money primarily through investments in U.S. Treasury securities and Money Market Funds (MMFs). However, due to changes in the Federal Reserve’s monetary policy and commercial bank re-regulation, investors are facing increased competition with central and commercial banks for access to U.S. Treasury securities, as well as reduced options for investments in MMFs […]

These changes have created a gap in investment portfolios, leaving unmet demand for floating rate, short-term products that are non-financial or government exposed. Investors therefore seek diversification away from fixed-rate, long-term products, U.S. Treasury securities and MMFs through alternative forms of investment.

One area of consideration for investors is trade finance [in all its variation, among those invoice trading] […]. This product offers investors the opportunity to invest in high quality, short term, non-financial credit risk in a floating rate product, which makes it particularly attractive for institutional investors in today’s challenging investment environment.

Trade finance broadly describes activities that involve financing and risk mitigation related to import/export, one flavor of which is account receivable and payable financing, commonly via purchases of receivables, loans against receivables or insurance against receivables. A specific form of trade finance, commonly referred to as confirmed receivable purchase (CRP) [or invoice trading], provides an attractive form of alternative credit investment for investors to consider.

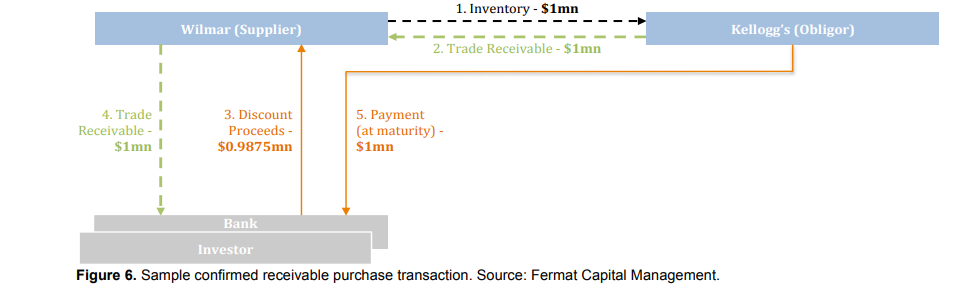

In a CRP [invoice trading], an account receivable is typically created as the result of a commercial trade transaction between a corporate obligor and supplier.

-

- An investor then agrees to purchase the receivable from the supplier early at a discount and upon the maturity of the receivable the investor is paid directly by the obligor (Figure 6).

- Additionally, the obligor typically waives their right to set off against the supplier and commits to paying the investor in full upon maturity. This is the “confirmed” part of the CRP [invoice trading], whereas an unconfirmed receivable purchase is one where the obligor does not acknowledge the sale of the receivable and therefore payment upon maturity flows through the supplier, introducing additional layers of risk to an investor. […]

Additionally, CRPs [invoice trading] tend to offer an attractive risk-adjusted yield. One way to determine this relative value is to compare CRPs [invoice trading] with corporate bonds for a single obligor.

There are a few primary factors driving this attractive relative value.

- The first is that pricing for CRPs is not solely linked to the primary credit risk of the obligor. This is because the discount rate at which an investor offers early payment to a supplier is linked to a number of factors, including the cost of capital of the supplier as well as the obligor while the credit risk is solely that of the obligor. Using the example presented in Figure 6, Wilmar most likely has a higher cost of capital than Kellogg’s (Wilmar is unrated while Kellogg’s has an investment grade rating), therefore investors are paid a higher discount rate than if they were providing an early payment to Kellogg’s. […]

- With limited high quality, short-term products available, CRPs [invoice trading] can offer high quality corporate credit risk in a floating rate, short-term form.

- And while there are significant and individualistic considerations that still must be taken into account, these features along with their attractive risk-adjusted yield make CRPs [invoice trading] an appealing alternative product for institutional investors to consider, particularly in the difficult environment investors currently and will continue to face.

Source: Fermat Capital Management LLC

CashMe is one of the leading Italian invoice trading marketplace allowing SMEs to get funded against outstanding trade receivables.

All invoices traded are subject to confirmation by the debtor and CashMe manages all the steps of the process ranging from the seller due diligence, to the debtor risk assessment, to the monetary transaction (thanks to a payment institution partner), to the credit collection. Generally the seller receives an advance payment equal to the 90% of the face value, and then the settlement of 10% minus the discount is paid upon maturity.

Since inception CashMe experienced a:

- gross yield of 11,83%

- a significantly low default rate (completely recovered thanks to the credit insurance policy)

- an average duration per invoice of 66 days

- an average invoice face value of € 40.000

For further details (loanbook, stats, etc) please contact us at info@cashme.it.